How to get more clients with SEO for veterinarians

What do you need SEO for if you are a veterinarian? Simple: attract traffic and turn it into paying customers! Learn how to optimize the structure and content of your website. … Read More

Sommario

Toggle[Important note: this article has been automatically translated from the original Italian language.]

At certain stages of one’s professional life, it may happen that one may have the impulse or need to leave everything and change one’s life.

Beyond the reasons for such drastic choices, one of the most “heartfelt” aspects is that of enhancing one’s facility, whether large or small.

The outpatient clinic or clinic, which with so many sacrifices we have opened and grown, represents a part of us and our lives.

From the point of view of those who have to sell no valuation will ever be sufficient, from the point of view of those who would like to buy all valuations will always be exaggerated.

Accountants, whom we rely on with confident hope, often provide us with estimates that are incomprehensible to us and sometimes cannot explain why they make these assessments.

It must be said that the evaluation of any productivity activity is always something quite “thorny.”

In fact, it is not about valuing a painting or a car, the value of which is represented by a few elements and very few variables.

This is a valuation of a “fixed” asset whose value, with few exceptions, tends to remain stable in the short to medium term.

Valuing an economic activity, on the other hand, is much more complicated starting from the fact that the economic activity is in the making, will also generate value in years to come, and is a productive investment and not an end in itself.

Over the past 50-60 years, distinguished academics have devoted themselves to this aspect of corporate finance, developing formulas and theories.

The enormous difference in size and types of businesses means that there is NO single, incontrovertible method for assessing the value of an economic activity, but it is necessary to choose the one best suited to the reality at hand.

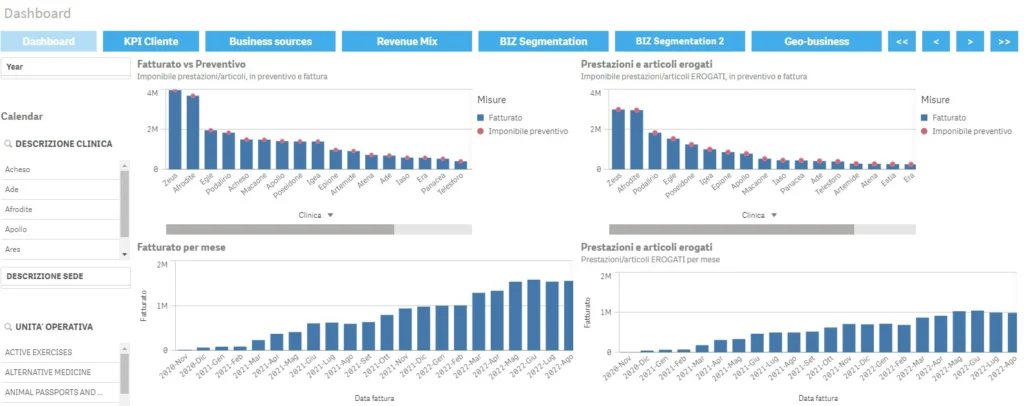

Perhaps the most widely used method, because of its simplicity and immediacy, is that ofEBITDA (Earning Before Interest Taxes Depreciation and Amortization) multiples.

EBITDA is a value that is derived from the income statement (your accountant can provide it to you) and expresses the profitability that acompany generates from its operations.

Consider that in the veterinary sector at one time this range was between 5X and 18X: this means that when faced with an EBITDA value of 100,000€ the valuation could range between 500,000€ and 1,800,000€.Which of the two is the right assessment? More scientific and significantly more complex methods have been developed to overcome this enormous discretion.

What is currently considered one of the most accurate methods is the DCF (Discounted Cash Flow) or discounted cash flow method.

This method assesses the value of the company by its ability to generate positive cash flows in the years to come, and thus generate value for the investor who goes to buy.

This method also has discretions, but the range of the estimate is between +/-15%.

However, in order to make these calculations, in-depth corporate finance skills and knowledge are required, and accountants are not always able to do this.

It is for

Bottom line.

Not everything that can be counted counts and not everything that counts can be counted.” A.Einstein

Related articles

What do you need SEO for if you are a veterinarian? Simple: attract traffic and turn it into paying customers! Learn how to optimize the structure and content of your website. … Read More

Let’s find out what a veterinary blog is really for, why people like it, and how it can bring you new clients. Here are 3 strategies you absolutely must know! … Read More

How long does it take you to arrange a surgery? How long does it take your staff to make a visit? How many drugs do you let expire?

If you can’t answer these questions, you are missing an important growth opportunity for your veterinary facility because you are not understanding where you can improve. … Read More

We are redirecting you to the cart to finalize the requested subscription change.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.